York's proposed budget adds $8 million in taxes

Real estate taxes would increase for the first time in 9 years

York County supervisors were pitched a $200 million operating budget at their Tuesday evening meeting that would raise spending by 5.8% and raise property taxes by nearly $8 million, including the county’s first real estate tax increase in 9 years.

The general fund budget, which covers most of the services taxpayers use, is part of a proposed overall budget of $288 million that includes construction spending, paying down debt and operating self-sustaining budgets like garbage collection.

Solid waste charges would increase by $2 every other month for all categories except the discounted senior citizens rate, which would go up $7.

“This budget is basically a maintenance budget with no new programs that were not already in place,” County Administrator Mark Bellamy said.

He said he had cut $15.2 million in budget requests from county staff before bringing supervisors the budget proposal.

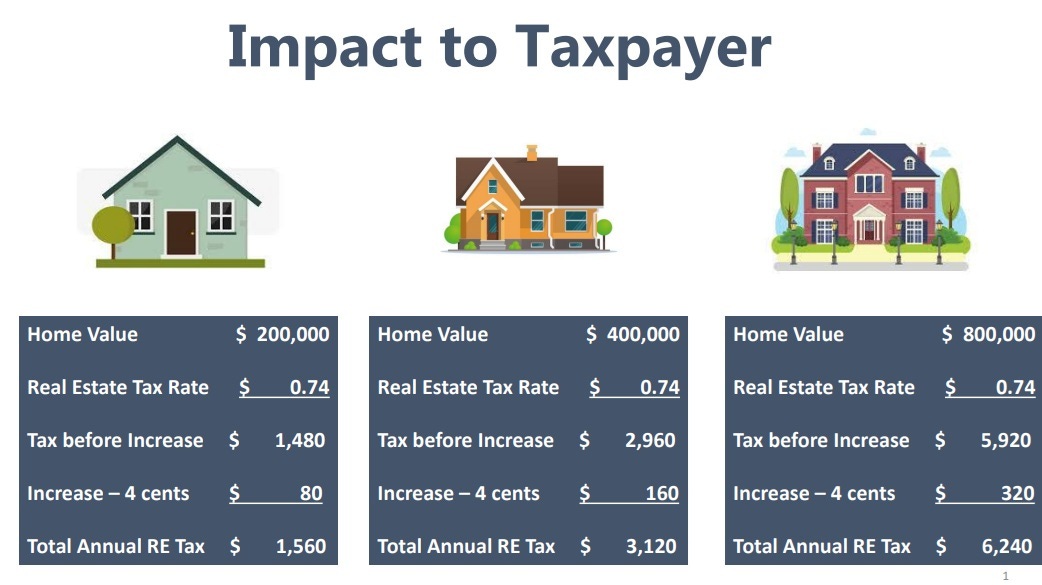

Bellamy stressed this would be York County’s first real estate tax increase in nine years, to 78 cents per $100 in assessed value. York County has lowered real estate tax rates three times since 2022 to offset increased real estate valuations.

Personal property taxes would go up by 20 cents back to $4 per $100 in value, where they stood two years ago before car prices doubled. Now that car prices have decreased, most car owners will pay less despite the higher rate, Bellamy explained.

The supervisors asked Bellamy to put together a list of budget cuts that would have to be made for every reduction of one penny in his proposed taxes.

“We need to see what our options are…. if we have to scale back something,” District 3 Supervisor Wayne Drewry said.

Bellamy noted that even with the proposed increases, York’s real estate tax rate would be the third lowest in Hampton Roads. Only Isle of Wight County and the city of Williamsburg would have lower real estate tax rates.

Its personal property tax rate would be the second lowest in the region, higher than Williamsburg and matching James City County, he said.

Because of inflation, the $96.3 million the county expects to receive from real estate taxes in the next year equates to less, in inflation adjusted terms, than it took in during 2016, county staff said.

“We’re fighting a losing battle” against inflation, Bellamy told the supervisors. He also noted that because York has Virginia’s third largest concentration of veterans, the cost to York of the tax relief veterans can receive on real estate taxes has tripled to $4.5 million in the past six years.

Real estate and property taxes generate more than 63% of the county’s revenue.

Paying for school operations and school debt repayments comprises the largest chunk of York County’s budget expense: 36.64%. Public safety is the next largest component, at 29.71%, followed by county administration costs at 6.96%.

The additional $11 million the county would receive with Bellamy’s proposed tax increases budget would be allocated as follows:

· $2.5 million for a 4% employee pay raise and to cover an 8% increase in medical and dental insurance costs.

· An extra $1 million for county schools, double the amount Bellamy originally discussed with the school administrator but $2.7 million shy of the schools’ ask.

· $2.4 million for public safety, including the full cost of seven employees added to the Sheriff’s and Fire departments this year.

· $3 million for debt service, cash capital and other funds.

· $1.3 million for increased operational costs.

· $800,000 for increased contributions to external agencies including the Virginia Peninsula Regional Jail, the regional library and the Williamsburg Area Transit Authority.

Bellamy said the real estate tax rate in the county’s public hearing notices will be set at 80 cents – two pennies higher than his proposed rate – to give supervisors some flexibility. While tax rates can be lower than the advertised rate, they cannot be set higher.

Here is the timeline for the proposed budget:

Town hall meetings on March 25 and April 3.

A March 27 meeting with the school board to discuss capital projects.

A formal public hearing before the board of supervisors April 15.

Budget adoption May 6.